Property Management Fees and Why They’re Necessary

Managing a rental property is overwhelming, especially when you're juggling responsibilities like finding tenants, maintaining the property, and keeping track of finances. That’s where property management companies step in to help. However, understanding property management fees is essential to make you’re getting the most out of their services while protecting your bottom line.

Table of Contents

1. What Are Property Management Fees?

Property management fees are the costs you pay for professional property managers to handle the day-to-day operations of your rental property. So what is included in property management fee? These fees cover services such as tenant screening, rent collection, maintenance, and addressing tenant concerns. When looking at how much these systems cost a property management company, you have to remember that property managers calculate in software and time, not just the price of the product itself. A simple example of this are background and credit checks. The services can run anywhere from $15.00-$35.00 directly from the company that conducts the background, however, there’s additional overhead that goes into reviewing an application and those costs have to be considered as well.

Make sure you’re receiving the biggest and best quality bang for your buck:

Research your prospective property managers and compare the percentages charged. This can vary by region and is usually negotiable if you have a special situation like being in the military, a first responder, etc, or if you are bringing on more than property.

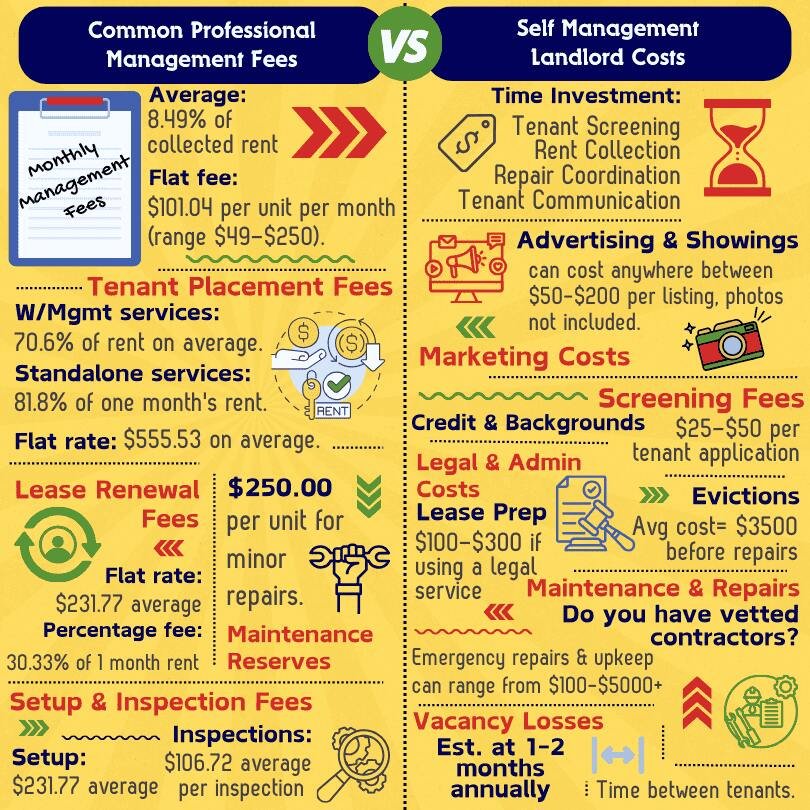

Compare the costs of hiring a property manager to managing a property yourself.

2. Why Property Management Fees Are Necessary?

Property management fees ensure your rental property operates smoothly and generates income without constant involvement from you. By outsourcing tasks, you save time and minimize stress while leveraging professionals who understand tenant laws, market trends, and operational efficiency.

Take time to do the calculations:

Consider how much your time is worth when deciding whether to hire a property manager.

Calculate the potential savings on mistakes or legal issues by hiring experts.

3. How Are Property Management Fees Calculated?

Most property managers charge a percentage of the monthly rental income, typically between 8%–12%. Some companies may also have additional fees for tenant placement, maintenance, or eviction services.

Crunch the numbers and verify all fees before signing the property management agreement:

Review your rental property’s income to estimate monthly fees.

Check your property management agreement for any hidden costs.

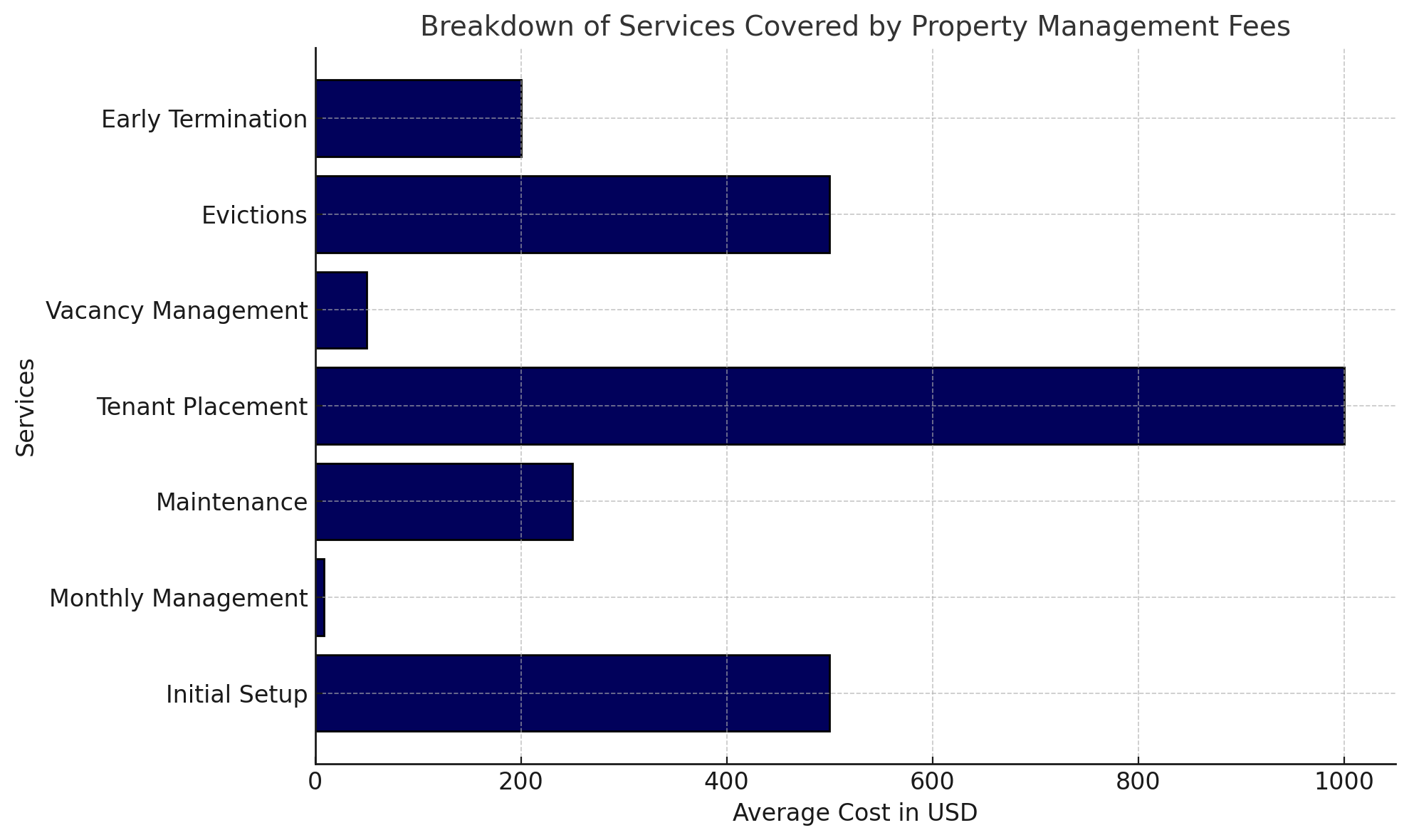

4. Types of Services Covered by Property Management Fees

The cost of property management includes services such as marketing your property, screening tenants, conducting inspections, and handling maintenance. However, some tasks, like major repairs, may require extra charges.

Cover your bases by being informed:

Request a breakdown of services included in the fees.

Confirm whether emergency repairs are covered or billed separately.

5. Property Management Fees vs. DIY Landlord Costs

While some property owners prefer a DIY approach, the cost of property management can be offset by the time saved and reduced stress. For example, property managers can help reduce tenant turnover and ensure legal compliance, which could save you money in the long term.

Vetted Contractors and reputable attorneys on retainer:

Compare the cost of property management fees with your estimated out-of-pocket expenses as a DIY landlord.

Evaluate the risks of legal issues or prolonged vacancies when managing properties yourself.

6. Understanding Insurance: Homeowners vs. Landlord Policies

Insurance is a critical part of rental property management. Homeowners insurance is designed for owner-occupied homes, while landlord insurance is tailored for rental properties and includes coverage for tenant-related risks, liability, and property damage caused by tenants. Most property management companies will require that you listed as additionally insured on your homeowner/landlord policy that you have through your standard insurance carrier.

Make sure your covered for the right situation:

Verify your current insurance policy type to ensure it matches your property’s use.

Evaluate SureVestor Protection Plus for enhanced landlord coverage, offering additional peace of mind.

Conclusion

Property management fees are a worthwhile investment for accidental landlords, real estate investors, and agents who value their time and want expert guidance. By understanding these costs, you can make informed decisions to maximize your rental property’s profitability while minimizing risk.

FAQ

-

Property management companies typically charge a monthly fee of 8%–12% of the monthly rent. If the rent on your rental property is $1,200 per month, the property management fee will likely range from $96–$144.

Source: RentSpree -

The landlord will almost always pay the property manager the cost of repairs and supplies before the property manager will actually perform them. Usually, this is an amount over and above the percentage of rent collected or other standard monthly fee. The landlord will fund an “escrow” with the property manager.

Source: All Property Management -

In the eyes of the IRS, landlords are like any other business owner and need to pay taxes on their profits. Luckily, costs associated with the property, including property management fees, are tax-deductible.

Source: Select Leasing STL -

Amounts paid for repairs and maintenance to tangible property can be deducted if the amounts paid are not required to be capitalized. However, a business may elect to capitalize amounts paid for repair and maintenance depending on their internal policies for handling books and records.

Source: Upkeep -

Property management fees cover the costs of a property management company's services, which typically include rent collection, tenant screening, maintenance coordination, and lease enforcement, among other tasks